OUR STRATEGY

Market-at-Glance discipline

Market-at-Glance is a discipline used by traders and investors to quickly assess the current state of the financial markets, while the Stock Trader's Almanac provides historical data and seasonal patterns in the stock market to help anticipate future market movements. Both tools are useful for traders and investors in making informed decisions.

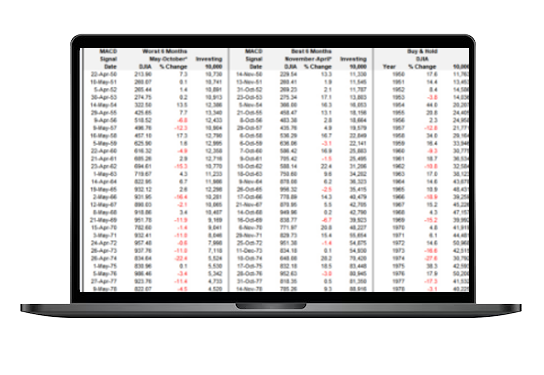

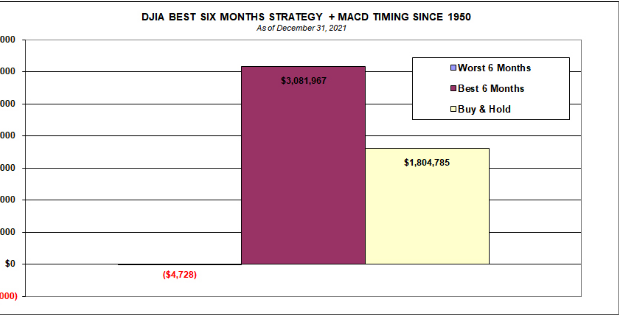

Seasonal Switching Strategy

The Seasonal Switching Strategy is recommended in the Stock Trader's Almanac for rotating an investment portfolio based on seasonal patterns in the market. It involves holding stocks during the favorable winter months and switching to bonds or cash during the less favorable summer months. Investors should carefully consider their own risk tolerance and investment goals before implementing this strategy

Sector Rotation Information

The Stock Trader's Almanac provides information on Sector Rotation, a strategy used by investors to capitalize on market trends by rotating their investments among different sectors of the economy. It offers analysis and recommendations on which sectors may perform well in different market conditions, as well as specific sector ETFs and mutual funds that can be used to implement a sector rotation strategy.

Stock Selection process for portfolios

The Stock Trader's Almanac provides a stock selection process for portfolios, which involves identifying undervalued stocks with good growth potential based on fundamental analysis and market trends. However, stock selection is a complex process that requires careful consideration of individual risk tolerance and investment goals

OUR STRATEGY CHOICE

Market-at-Glance discipline

Seasonal Switching Strategy

Sector Rotation Information

Stock Selection process for portfolios